Some Known Questions About Clark Wealth Partners.

Table of ContentsThe Main Principles Of Clark Wealth Partners 7 Simple Techniques For Clark Wealth PartnersThe Ultimate Guide To Clark Wealth Partners10 Easy Facts About Clark Wealth Partners DescribedOur Clark Wealth Partners StatementsThe Ultimate Guide To Clark Wealth PartnersNot known Details About Clark Wealth Partners Top Guidelines Of Clark Wealth Partners

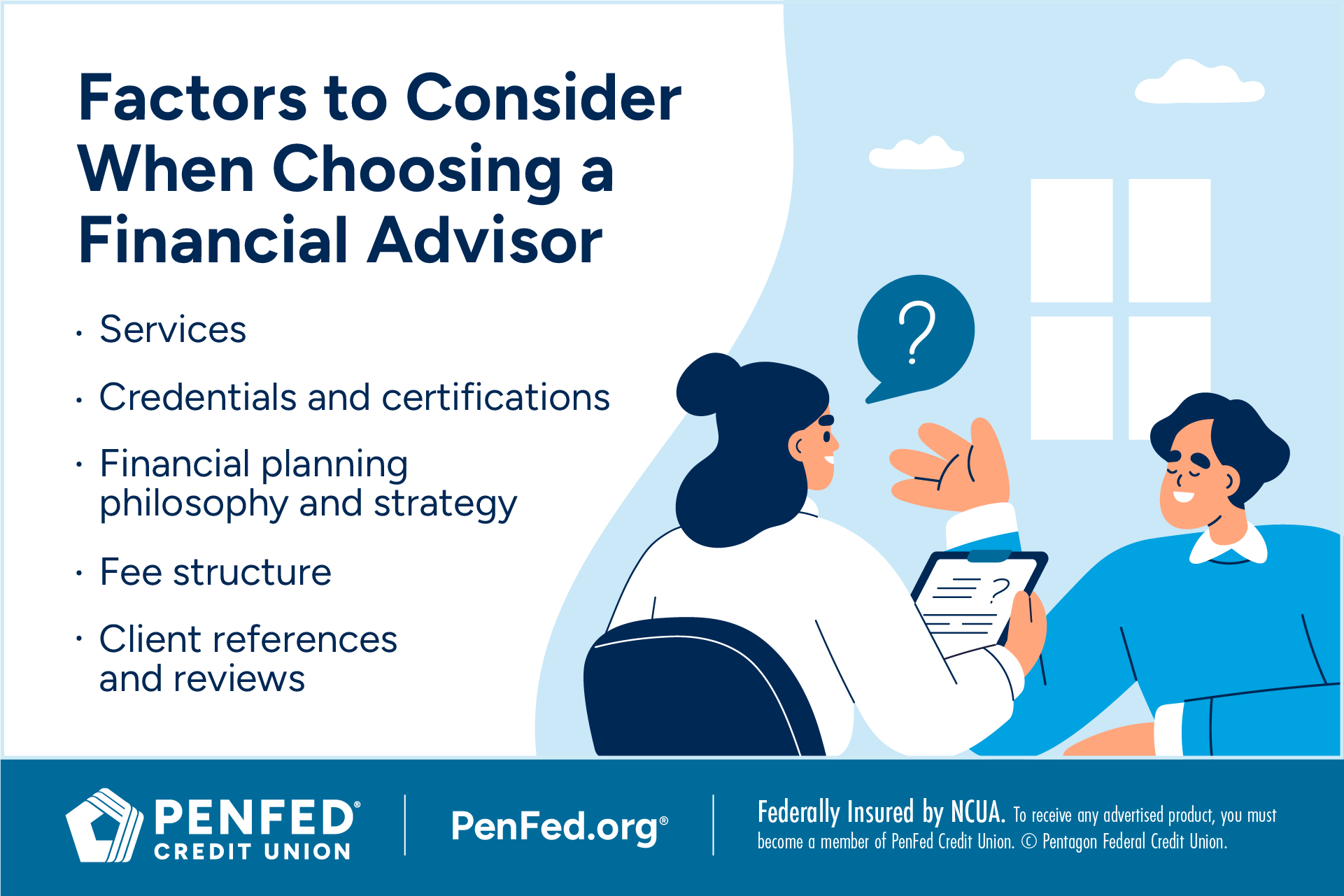

Common factors to consider a financial expert are: If your economic circumstance has actually come to be much more intricate, or you lack self-confidence in your money-managing abilities. Saving or navigating significant life occasions like marital relationship, separation, youngsters, inheritance, or job modification that may dramatically influence your economic situation. Navigating the change from saving for retired life to preserving riches during retirement and just how to create a solid retired life earnings strategy.New technology has actually led to even more extensive automated financial devices, like robo-advisors. It depends on you to check out and determine the appropriate fit - https://clark-wealth-partners.webflow.io/. Inevitably, a great financial consultant needs to be as conscious of your financial investments as they are with their own, staying clear of extreme fees, conserving money on taxes, and being as clear as feasible concerning your gains and losses

Excitement About Clark Wealth Partners

Making a compensation on product recommendations does not always indicate your fee-based expert antagonizes your benefits. They may be extra likely to recommend products and services on which they earn a compensation, which may or might not be in your ideal rate of interest. A fiduciary is lawfully bound to place their customer's interests.

They may comply with a loosely kept an eye on "viability" requirement if they're not registered fiduciaries. This common allows them to make suggestions for investments and services as long as they fit their customer's objectives, risk resistance, and monetary scenario. This can convert to referrals that will likewise earn them money. On the other hand, fiduciary consultants are lawfully bound to act in their client's benefit as opposed to their very own.

What Does Clark Wealth Partners Do?

ExperienceTessa reported on all points spending deep-diving right into complicated financial topics, clarifying lesser-known investment avenues, and discovering means readers can function the system to their benefit. As an individual financing specialist in her 20s, Tessa is really knowledgeable about the effects time and unpredictability carry your financial investment decisions.

It was a targeted advertisement, and it worked. Find out more Check out less.

The Buzz on Clark Wealth Partners

There's no solitary route to coming to be one, with some people beginning in financial or insurance coverage, while others start in audit. A four-year level offers a strong structure for jobs in financial investments, budgeting, and client services.

Top Guidelines Of Clark Wealth Partners

Common examples consist of the FINRA Series 7 and Collection 65 examinations for securities, or a state-issued insurance policy permit for offering life or wellness insurance policy. While qualifications may not be legally required for all preparing roles, employers and clients often see them as a criteria of professionalism. We check out optional credentials in the next section.

The majority of economic organizers have 1-3 years of experience and experience with monetary items, conformity standards, and straight customer interaction. A strong educational background is crucial, but experience shows the capacity to apply concept in real-world setups. Some programs combine both, permitting you to complete coursework while making monitored hours via teaching fellowships and practicums.

The Ultimate Guide To Clark Wealth Partners

Numerous go into the area after working in banking, bookkeeping, or insurance coverage, and the change calls for perseverance, networking, and frequently innovative qualifications. Early years can bring long hours, pressure to develop a customer base, and the demand to continuously show your know-how. Still, the occupation offers strong lasting potential. Financial planners enjoy the opportunity to work closely with customers, overview important life decisions, and commonly achieve adaptability in timetables or self-employment.

They invested less time on the client-facing side of the market. Nearly all financial managers hold a bachelor's level, and many have an MBA or similar graduate degree.

The 9-Second Trick For Clark Wealth Partners

Optional certifications, such as the CFP, normally need extra coursework and testing, which can expand the timeline by a couple of years. According to the Bureau of Labor Stats, personal monetary advisors earn an average yearly yearly wage of $102,140, with leading earners gaining over $239,000.

In various other provinces, there are regulations that require them to meet certain requirements to use the monetary consultant or financial coordinator titles (financial advisors illinois). What sets some monetary advisors apart from others are education, training, experience and certifications. There are several classifications for monetary advisors. For monetary planners, there are 3 usual classifications: Certified, Individual and Registered Financial Organizer.

How Clark Wealth Partners can Save You Time, Stress, and Money.

Those on salary company website might have a motivation to promote the items and solutions their companies provide. Where to find an economic expert will rely on the type of recommendations you require. These establishments have personnel that might aid you comprehend and get specific sorts of financial investments. For instance, term down payments, guaranteed financial investment certificates (GICs) and common funds.